Yield curves are flattening: fear of rate hikes?

Hello guys,

I hope you are fine.

Thanks to everyone who signed up. If you haven’t already, tap the button below.

Let’s see last market events.

Curves are flattening

One of the most interesting developments of the week is the flattening of many yield curves, U.S. included. What does that mean?

Basically it means that the yields on short maturities are rising, while the yield on longer maturities are falling.

Look at the picture below to better understand that.

As you can see above, there has been a big rise of the yields in the range 2y-7y, while the 30-Year now has a lower return than the 20-Year.

Maybe you can think that this is not relevant, but investors are looking at that chart very carefully.

The flattening of the curve is a sign that markets expect central banks to make rate hikes sooner than expected to respond to growing inflation, which could slow economic growth significantly.

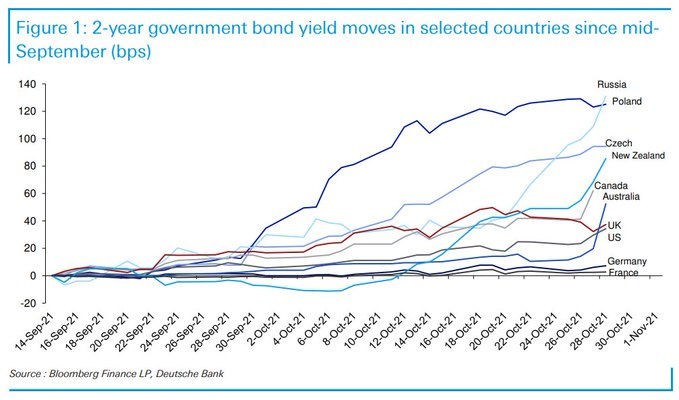

The same is happening in many developed countries, like Canada, U.K., Australia, Germany and others. Just look below at the 2-year government bonds move.

We will see if Central banks will really become more hawkish or if markets are going in the wrong direction.

Earnings: something good, something not

This one has been the most important week for earnings: the tech giants reported their results with mixed outcomes.

Google and Microsoft posted very good earnings, beating expectations on revenue and earnings. Both stocks reacted very well, and now Microsoft is once again the most valuable firm in the world.

Facebook results have been in line with estimates, while the delusions came from Amazon and Apple.

Amazon gave a disappointing guidance for the incoming holiday season, and said that its profit could be wiped out because of a rise in the cost of labor and fulfillment.

Apple reported lower than expected revenue, because of supply chain bottlenecks. Even a giant like Apple is in trouble because of chip shortage.

Meanwhile more than half of S&P 500 companies reported their earnings and, on average, they are going better than expected, but the surprise is much lower than it was in the previous quarters, especially on sales side. Below you can see the average surprise for the S&P 500 companies.

Disappointing results together with more hawkish central banks can be a source of concern for equity investors, but it is still early to be worried. So far stocks are still reacting well, and the S&P 500 is very close to its all-time highs.

Inflation estimates rising, Buy inflation winners

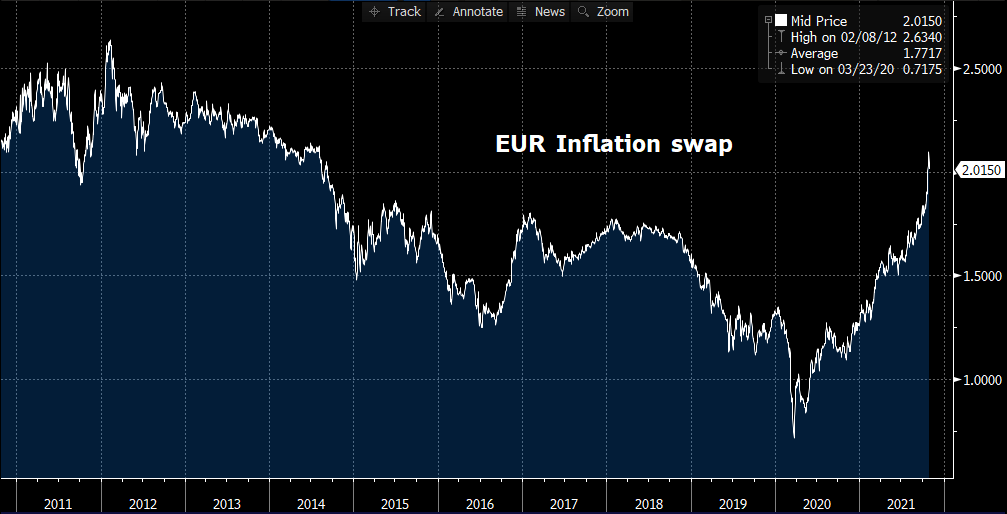

Here you can see what are market expectations for US and Europe inflation (I used the Inflation swap forward 5y5y).

Inflation expectations are rising, but are they rising enough to force central banks to rise rates sooner than expected? I don’t think so!

The FED is not interested in slowing growth and derail the already fragile economic recovery, and it will try to postpone as much as possible any rate hike. The current move from smaller central banks won’t force FED to change its playbook: tapering is going to start in November/December 2021, and it will end in summer 2022. After that they will probably start to increase rates.

Even the ECB is going to be very conservative in my opinion.

So, where to invest?

In the “tapering base case” described above, I still see equities as a positive asset class. There will probably be more inflows on equities in the incoming weeks, and even in case of small corrections I would not be really worried.

The macro picture is not changed.

Inflation is rising and it will be high for a while! The best way to face this phase probably is to buy inflation winners!

I already wrote several times that there are currently some very interesting sectors: financials, energy, materials and industrials. Those are historical winners in high inflation environments.

Most interesting play?

I am really interested in European banks, a potential catch up play:

What to do with tech stocks?

There could be temporary corrections due to historically high valuations and rising rates, but I would see any drawdown as a buy opportunity to jump on quality companies with reasonable valuations.

Few stocks that are on my radar?

Facebook

Paypal

Micron Technology

Zynga

Always make your research before to make any investment!

Have a good weekend!

Market Radar

Disclaimer: Market Radar is not an investment advisor. Any information provided as part of the services is impersonal and not specific to any person’s investment needs. You acknowledge and agree that no content published or otherwise provided as part of any service constitutes a personalized recommendation or advice regarding the suitability of, or advisability of investing in, purchasing or selling any particular investment, security, portfolio, commodity, transaction or investment strategy.