Hello Guys,

Welcome to all new subscribers and welcome back to the old ones!

Please share the newsletter with any friend that could be interested! Thank you!

Today I will show you some chart with a focus on the recent analysts and strategists calls on S&P 500.

Bear Market? Not for Citigroup

Periodically Citigroup publishes the Bear Market Indicator Checklist, that measures market excess by different metrics (for example sentiment, valuation, profitability).

As you can see, the indicator checklist was able to find previous market exuberances that led to bear markets. Today, the number of “Caution” and “Danger” signals is quite low, and the outcome is positive for equities: bear market could not be very close.

Despite that, this week Citi strategists (led by Robert Buckland) cut U.S. Equities to Neutral.

Why? They see 10 Year Treasury yield to go toward 2% going into next year and that will affect tech and growth stocks. They overweight financials and materials, historically good performers in a rising rates environment. To sum up, they see the reflation trade to comeback (painful summer so far!).

Analysts are too optimistic?

Both in Europe and US the number of “Buy” recommendations reached levels not seen in the last 10 years. Buy rating for companies listed in Europe stands at 52% (high since 2011) while in US the number of buy is at 56% (high since 2002).

Maybe we are not close to a bear market, but analysts ratings must be taken very carefully: in many cases they proved to be slow to react to market changes and this high levels could signal too much euphoria.

Don’t make your investment decisions based only on those rating.

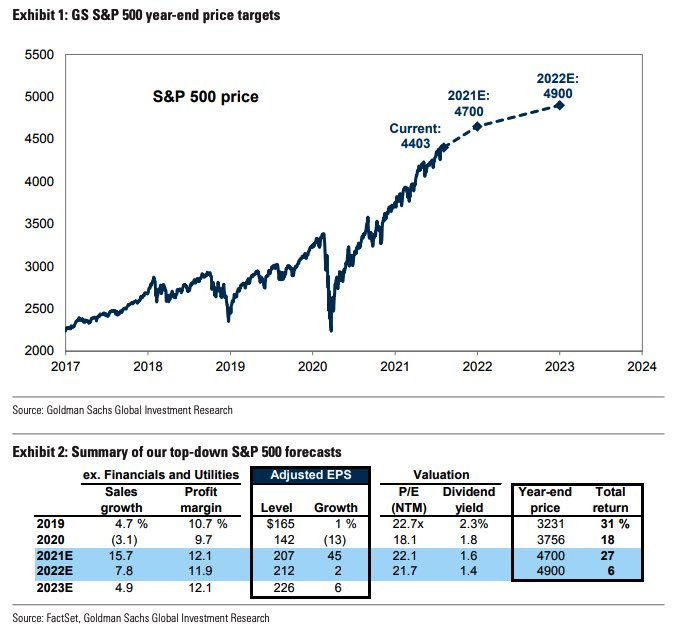

Goldman Sachs raised S&P 500 price target

As already saw on my Instagram page, Goldman Sachs just raised its forecasts on S&P 500 for 2021 (from 4300 to 4700) and 2022 (from 4600 to 4900). What were the drivers behind the upgrade? basically higher earnings than expected and lower interest rates.

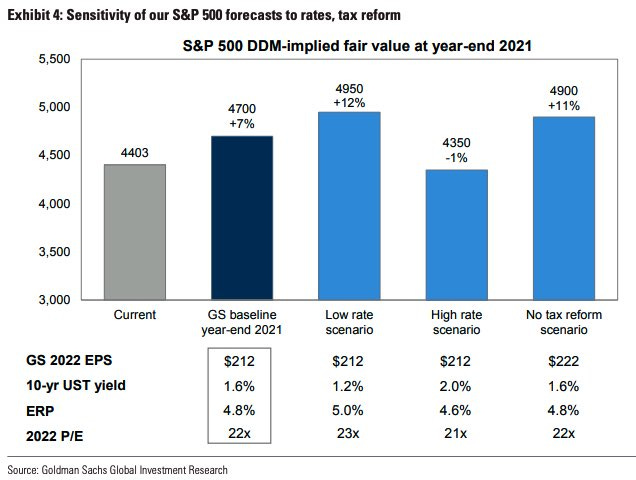

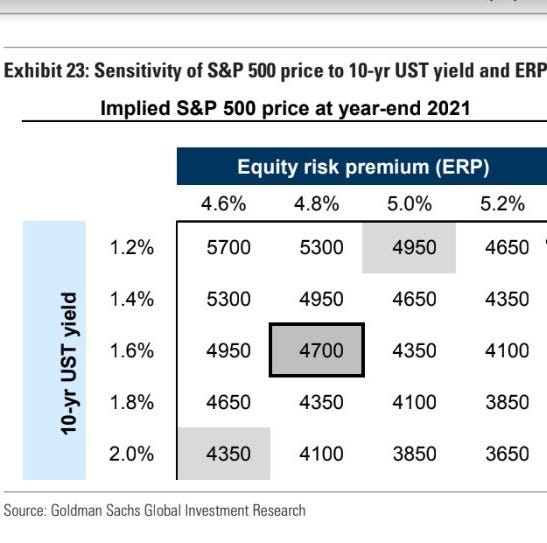

Goldman sees the above target prices as the base case of its analysis, but they obviously did even a sensitivity analysis, where they try to calculate the S&P 500 values based on different scenarios:

Look at the charts above and see why it is fundamental to look at the markets as a whole: a move in the bond market can seriosuly impact the equities. For example, Goldman sees 2021 target price much lower in case the 10 Yr Treasury yield will increase until 2% by the end of the year. On the other side, an higher ERP would imply a lower price for the S&P 500.

Of course this is just an assumption from an investment bank: Don’t take that as a Bible!

The Big recap

Here a brief recap of the S&P 500 target prices from the most known strategists (from the biggest investment banks):

Goldman and Oppenheimer are the most bullish, and they see a potential upside of almost 7% for the rest of the year.

On average, there isn’t too much optimism, if you consider that today (6th August) the S&P 500 is trading at 4,430, 2% higher than the average 2021 Target Price.

Who is the most skeptical? Apparently Bank of America, that has a target of 3,800 (14% lower than current price), but it has the same target from the beginning of the year. Time to make an update?

Why strategists don’t see a bear market coming?

One of the main reasons why analysts don’t see a bear market ahead (but a correction is possible) is in the bond market.

In the first 3 months of the year, the furious rise of the yields, supported by very positive economic data, made many investors and strategists (and even me) believe that the Treasury was immediately going to 2%, but the opposite happened.

Weak data on Job market together with new fears on Delta variant cooled the spirits, and the yields started to go down again. The fall happened not only in US, but even in Europe. Just give a look to Germany:

Now the German Yield curve is totally negative, even on 30 years maturity!

You can understand that bonds are again unattractive, and investors are forced to look for returns in the equity market (TINA: There Is No Alternative), so every dip will probably be bought, as long as the macro situation will remain stable. If not (for example, in case several economic data “better than expected” will arrive), markets could take a new direction…

Have a great weekend guys!

Market Radar

Disclaimer: Market Radar is not an investment advisor. Any information provided as part of the services is impersonal and not specific to any person’s investment needs. You acknowledge and agree that no content published or otherwise provided as part of any service constitutes a personalized recommendation or advice regarding the suitability of, or advisability of investing in, purchasing or selling any particular investment, security, portfolio, commodity, transaction or investment strategy.