Hello everyone,

The community is quickly growing, and I am very thankful to all of you.

If you are interested in reading my articles, but you haven’t subscribed yet, do it now!

What’s happening on markets?

The beginning of October confirmed that there is confusion on markets: we are watching big swings every day. As you can see in chart below, the S&P 500 daily % range is going up quickly.

In any case, so far the performance of the indices has been slightly positive MTD.

But what is making markets more nervous?

This week commodities took the stage, as oil reached new highs, but especially natural gas prices skyrocketed before to make a strong inversion.

On the oil side, OPEC+ agreed to make an expected output increase of 400k b/day (next meeting is due on 4th November), a quantity that still leaves the world in a supply shortage, especially if we consider that the oil demand is now close to 2019 levels:

Moreover, usually the US shale oil production grows quickly when the prices go up, but not this time:

Why? There is a possible explanation linked to ESG and the difficulties for shale oil producers to have access to fresh money.

All the above elements can fuel the oil rally for more weeks, and some strategist started to call oil at 100$ in one year (like BofA).

The most notable commodity of the week has been natural gas, that created lot of worries especially in Europe, a big gas importer. The price increased vertically for 2 days, before Putin said that Russia is ready to increase the gas flow toward Europe and to help stabilize energy markets.

After Putin speech, the price quickly collapsed, as you can see in the chart above.

Why markets are so worried about oil and gas prices?

One possible explanation is “stagflation”.

If you don’t know what it means, please read this brief explanation: Stagflation is a period when slow economic growth and joblessness coincide with rising inflation (Source: World Economic Forum).

One of the possible causes of stagflation is “high energy prices”, mainly because an increase of oil prices reduces the economy’s productive capacity, hurting the economic growth.

The recent increase in oil and natural gas prices led people to search for stagflation much more than before.

Why investors are scared by stagflation? Mainly because it is very hard to face for policymakers, and one of the worst scenarios for your portfolio (both on equity and bond side).

Is stagflation coming?

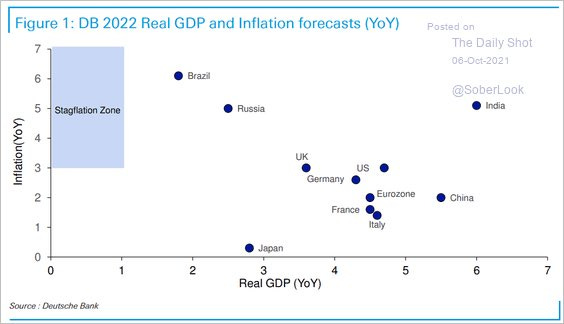

Apparently we are still far from that scenario, but we cannot totally exclude that for the foreseeable future. A chart from DB can be useful to understand the current situation:

The economies of the most developed countries are in a “strong recovery” mood, after one year of deep fall, but the recovery is fragile and there are several risks that can slow down growth: apart from Covid, the supply chain bottleneck is proving to be persistent, hurting production and causing an increase in inflation.

If those bottlenecks will persist more than expected and the oil and gas prices will continue to grow, the stagflation risk will become higher.

Recently Marko Kolanovic, Co-head of Global Research for JP Morgan, wrote in a note that “We do not believe that the current price of energy will have a significant negative impact on the economy”. They think that the market and economy can grow even with higher rates and oil prices (indeed they suggested to buy the dip after the recent 5% drawdown of the S&P 500).

Moreover it will be very relevant to follow the upcoming earnings season, in order to understand if the earnings growth is losing pace and what companies will say about their guidance and the bottlenecks in supply chain.

We’ll see if the actual results will be much higher than expectations, as happened in the last 5 quarters.

Where to invest now?

This week lot of job data have been released: ADP Employment Change (better than expected), jobless claim (better than expected), Nonfarm Payroll (much lower for September, but upward revision for August) and Unemployment rate (lower than expected even if the participation rate has been lower than a month ago).

The total results were mixed, but are they enough bad to let Fed to postpone tapering? Not in my opinion.

So I don’t see any material change on the investment outlook from a week ago: Treasury Yield can keep rising (and the ETF short on 20+ Treasury, TBF, is still interesting).

I remain positive on cyclicals, especially on sectors like energy, financials and consumer discretionary, and positive on mid & small cap (that usually tend to overperform together with value stocks).

Interesting geographic areas are U.S. (on cyclical sectors), Europe and emerging markets, exporters of oil and gas (Russia for example).

Especially I see european banks as a very attractive spot. They are now cheaper than 2011 (European debt crisis) compared to the Stoxx 600, both if we use P/E and P/B as valuation multiples:

What to do with tech stocks? My idea is just to hold them.

In the long term they are a good investment, and generally better than cyclicals, but in the short term they could suffer the rising yields. Moreover any significant drawdown could offer great entry points on tech stocks.

In any case I currently prefer the large cap rather than pure growth plays on tech sector, because of less extreme valuations and potentially less downside risk.

I hope you enjoyed the article: please like the post and feel free to leave a comment if you have any question.

Have a great weekend!

Market Radar

Disclaimer: Market Radar is not an investment advisor. Any information provided as part of the services is impersonal and not specific to any person’s investment needs. You acknowledge and agree that no content published or otherwise provided as part of any service constitutes a personalized recommendation or advice regarding the suitability of, or advisability of investing in, purchasing or selling any particular investment, security, portfolio, commodity, transaction or investment strategy.