Hello guys,

I hope everyone is having great time and investing well.

If you are reading this newsletter, but you haven’t subscribed yet, do it now!

Positive surprise on earnings

The earnings season is started and almost 20% of the S&P 500 companies already released their results, but only few of the tech megacap (Apple, Microsoft, Google, Amazon and FB coming next week).

So far things are going well:

Above you can see a recap of the Q3 results. On average companies are beating expectations both on sales (+2%) and earnings (+11.7%).

Financials has been the sector with the highest beat on earnings. Banks have been very resilient in Q3, and they should be well placed to benefit from higher rates (10 Year Treasury Yield is now close to 1.7%).

Netflix has been the first of the FANG to report the results, that have been generally positive, but the expectations are high and beating them could be not enough to see stocks to go up.

It’s soon to give a more detailed opinion on tech stocks. Better to see more numbers next week.

In any case the surprise on earnings has been high so far, but not as high as in previous quarters (look at the above picture in the section “historical analysis” for a comparison).

S&P 500 in a winning streak, but overbought

The first part of October has been very good, and most of the equity indices are positive MTD, especially in U.S.

The good results of the first earnings gave a boost to the Nasdaq 100, which has quickly gone from being the worst to the best index of the month.

I have already written about that last week: equities desperately needed (and need) a good earnings season to continue to go up.

In any case, after this recent rally, the S&P 500 is now close to overbought territory.

In the above study Bloomberg Analysts used the GTI Global Strength Indicator. The indicator is now close to 70, which generally triggers a sell signal.

In the past two years the sell signals have been quite good to anticipate a weakness in the index, or better, an incoming dip to buy.

We are not there yet, but don’t be surprised if the stocks rally will take a break.

Fund Managers still afraid of inflation

Halloween is close: have you decided what to dress up as?

I have an idea: Inflation!

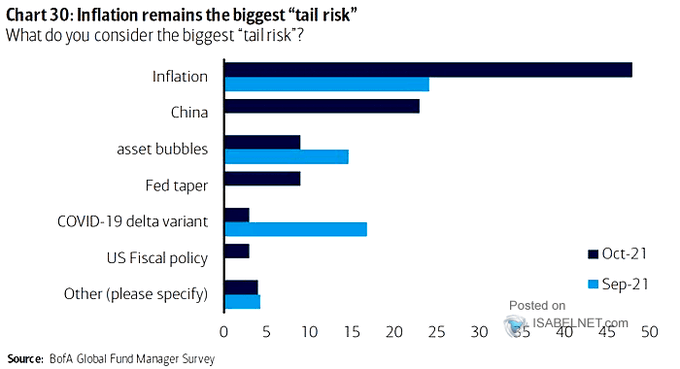

In the monthly survey BofA asked to fund managers: What do you consider the biggest “tail risk”? More than 50% of the respondents said “inflation”.

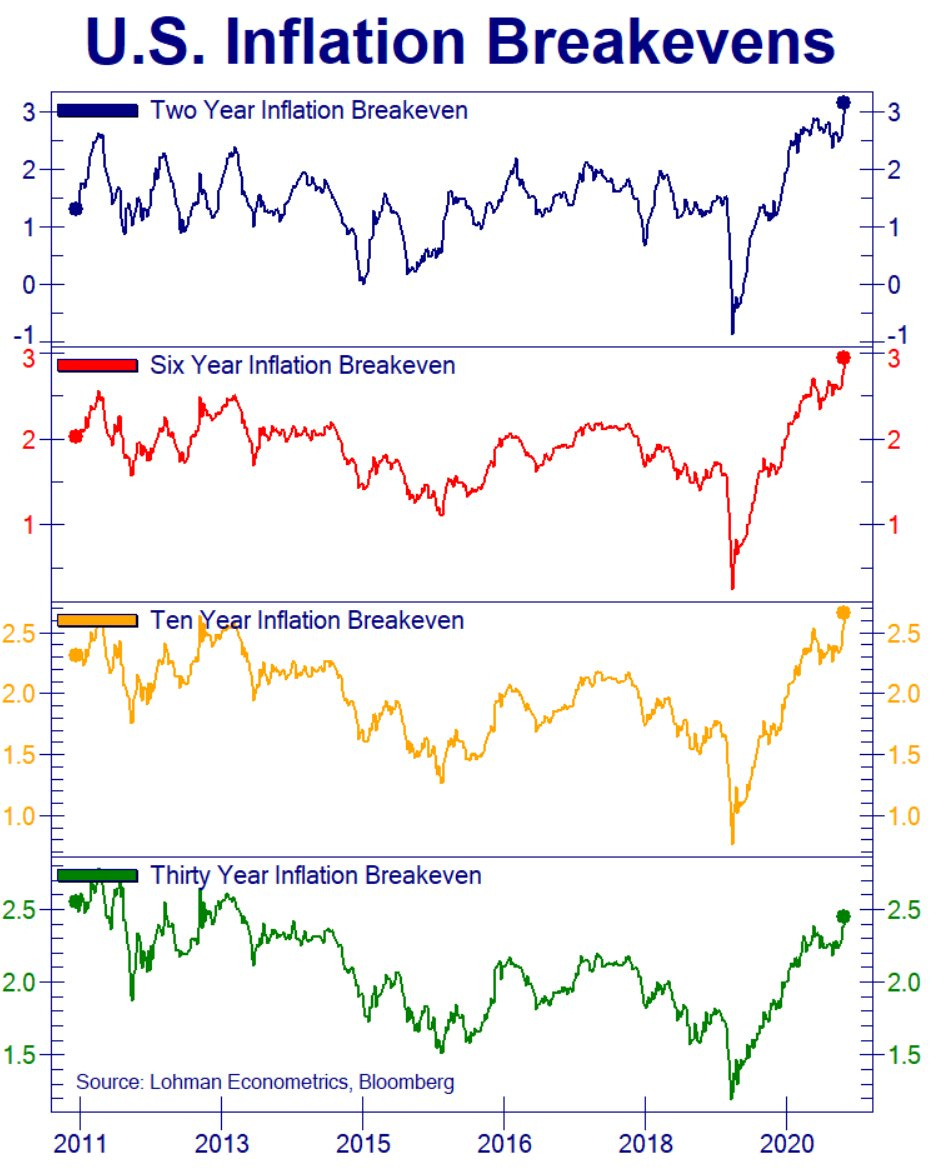

Markets agree with them: inflation breakevens just reached new fresh multi-year highs. Investors don’t believe too much to the transitory story.

VIX: too low to ignore?

Lastly I would like to show something interesting about Vix Index (even known as volatility index).

I am not a Vix expert, but after the recent equity gains, the Volatility index dropped quickly to the lowest levels since the beginning of the pandemic.

Are investors becoming too complacents? Stocks proved to be strong in the last year but currently there are several risks that can derail the rally: for example inflation, tightening monetary policy, China Real estate market collapse, resurgence of Covid.

If just one of the above risks will become more “concrete” equities could take an hit.

Even fund managers see higher VIX as the most likely outcome in the base case tapering scenario (from Nov ‘21 to Jun ‘22), followed by stronger USD.

Maybe it is worth to look for some protection? It is becoming cheaper day after day.

Always make your research before to make any investment!

Have a good weekend

Market Radar

Disclaimer: Market Radar is not an investment advisor. Any information provided as part of the services is impersonal and not specific to any person’s investment needs. You acknowledge and agree that no content published or otherwise provided as part of any service constitutes a personalized recommendation or advice regarding the suitability of, or advisability of investing in, purchasing or selling any particular investment, security, portfolio, commodity, transaction or investment strategy.