Welcome back guys!

I hope you are all fine!

Another week is almost over, but it has not been an easy week for markets. Why? Mostly because of inflation data.

Inflation higher than expectations

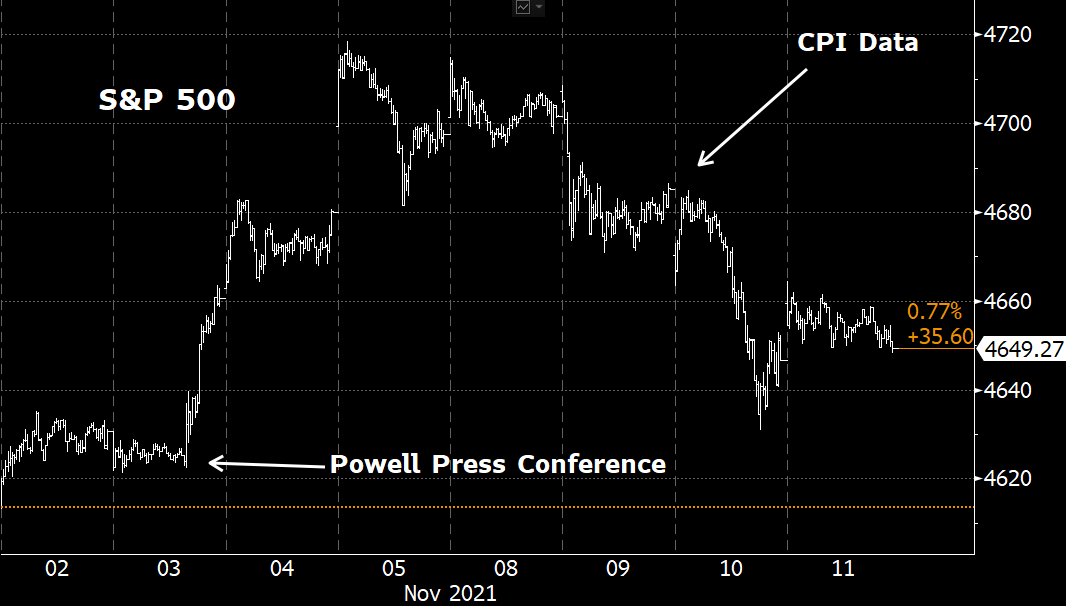

Just 10 days ago Jerome Powell have reassured investors with a very dovish speech, and the effect on equities has been very positive. Unfortunately part of the gain evaporated after last CPI data.

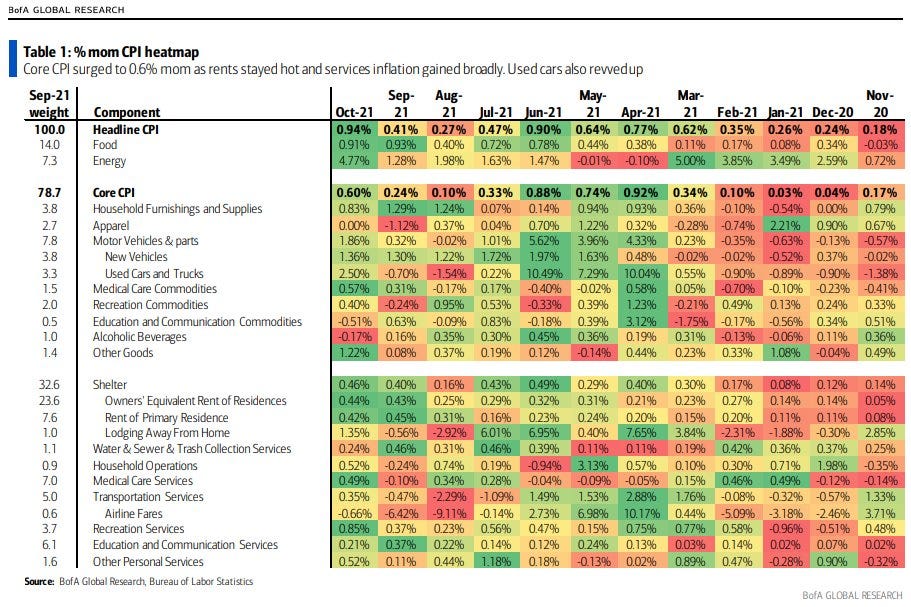

On Wednesday, data on inflation have been much higher than expected.

Investor fear has risen mostly because this time the price increased for most of the categories included in the report (not only food, energy and used cars).

At the beginning, markets reacted in the most obvious way: 10-Year Treasury Yield up, US Dollar appreciation, Nasdaq down and Dow Jones up.

In the following days equities have stabilized, and Treasury Yield remained close to 1.55%.

In other parts of the world the effect has been much weaker: European and Asian equities did not had any notable impact.

The unloved gold is back in fashion?

Gold has been among the biggest winners of the last week, and it is on track for its biggest weekly gain in the last six months.

This could sound strange for some of you, especially because this year gold reacted bad after news or data on rising inflation. Indeed during the year, investors started to bet on an hawkish FED, ready to unwind monetary stimulus in order to face inflation, and gold should not be a good performer in a scenario like that.

But the last Powell press conference changed the macro picture: he was very dovish, and he made investors understand that FED will not force any rate hike or accelerate tapering. A dovish FED and a rising inflation is a positive setup for gold (because real rates go down and gold is negatively correlated with real rates).

The result has been a huge breakout:

Gold has been very snubbed by investors this year, indeed gold ETF holdings decreased sharply, as you can see in the chart below.

After several months of outflows, investors will consider again to put some of their money on gold, and the inflows could push the price up.

Moreover central banks have started to buy lot of physical gold again:

Finally I’ll show you the negative correlation between gold and real rates:

Weaker real rates should boost gold prices. In my opinion the setup for an investment in gold is now promising.

Dollar Index: another notable breakout

Another asset with a very interesting setup is US Dollar. Look at the Dollar Index chart:

The current breakout of the resistance at 94 could signal the continuation of a bullish trend, started few months ago. There are several reasons to support a bullish USD: of course, one of them is inflation, much hotter in US compared to other parts of the developed world (for example EU).

Please remember to make your own study before to make any investment.

Have a great weekend!

Market Radar

Disclaimer: Market Radar is not an investment advisor. Any information provided as part of the services is impersonal and not specific to any person’s investment needs. You acknowledge and agree that no content published or otherwise provided as part of any service constitutes a personalized recommendation or advice regarding the suitability of, or advisability of investing in, purchasing or selling any particular investment, security, portfolio, commodity, transaction or investment strategy.