Hello Guys,

I hope you are all fine!

If you are reading this article but you have not subscribed yet, do it now! Use the button below!

Do you want to have full access to two model portfolios?

Please consider to become a premium subscriber!

Here an introduction to the two portfolios:

Let’s see what is happening on markets!

Equity indices are still down YTD, but there has been an interesting rebound last week (one of the best of the last 2 years).

Here you can see the YTD return for the main indices:

Right now investors are mainly focused on two themes:

Central Banks

Conflict in Ukraine

The first rate hike

Finally last week the Fed started a new rate hike cycle.

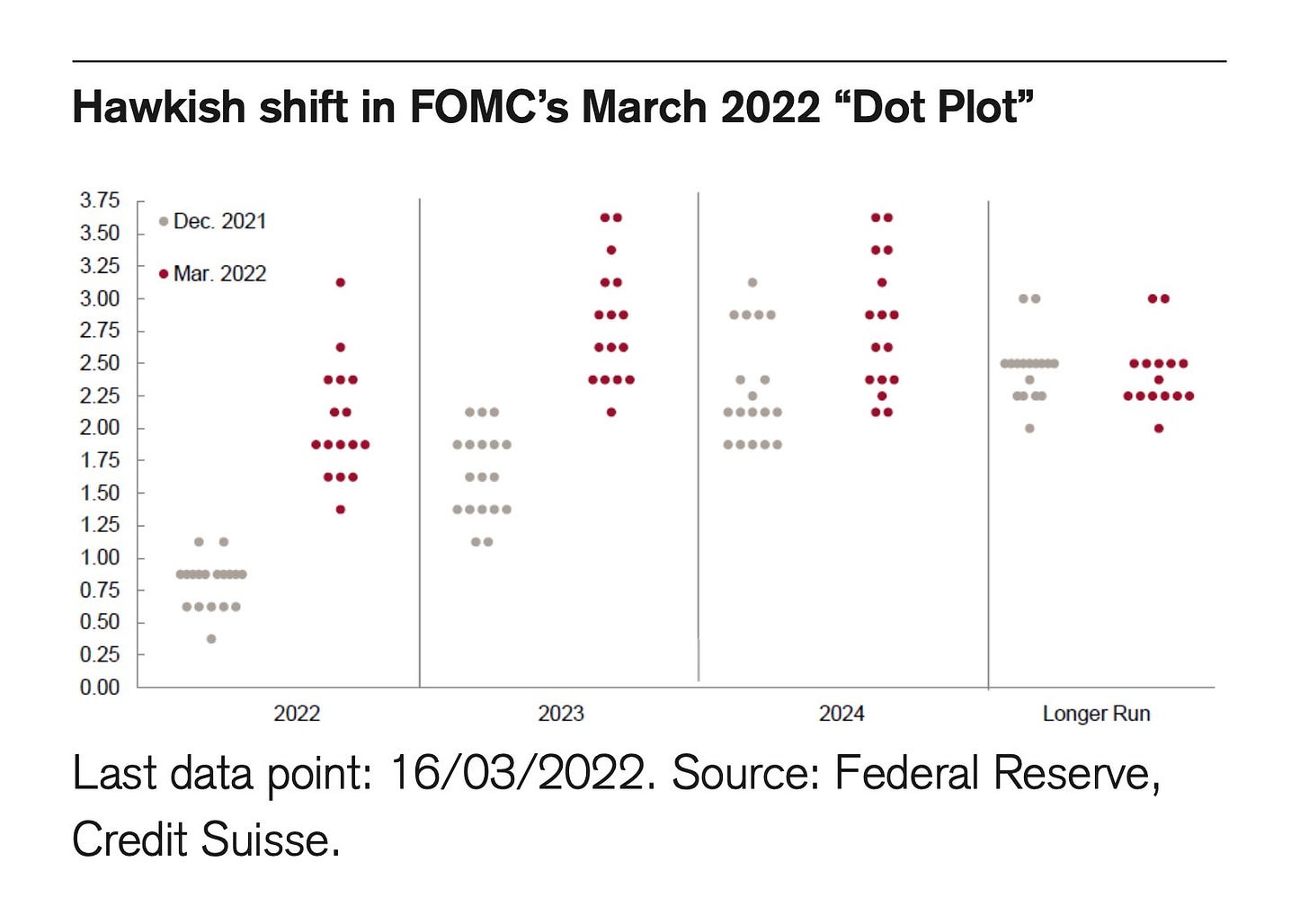

As highly expected the central bank increased rates by 25 bps, but it even released a more aggressive view for the future: the new dot plot shows how Fed Officials foresee more rate increases for the rest of the year, and for next years, compared to December 2021.

As you can see above the forecasts includes higher rates for 2022, 2023 and 2024.

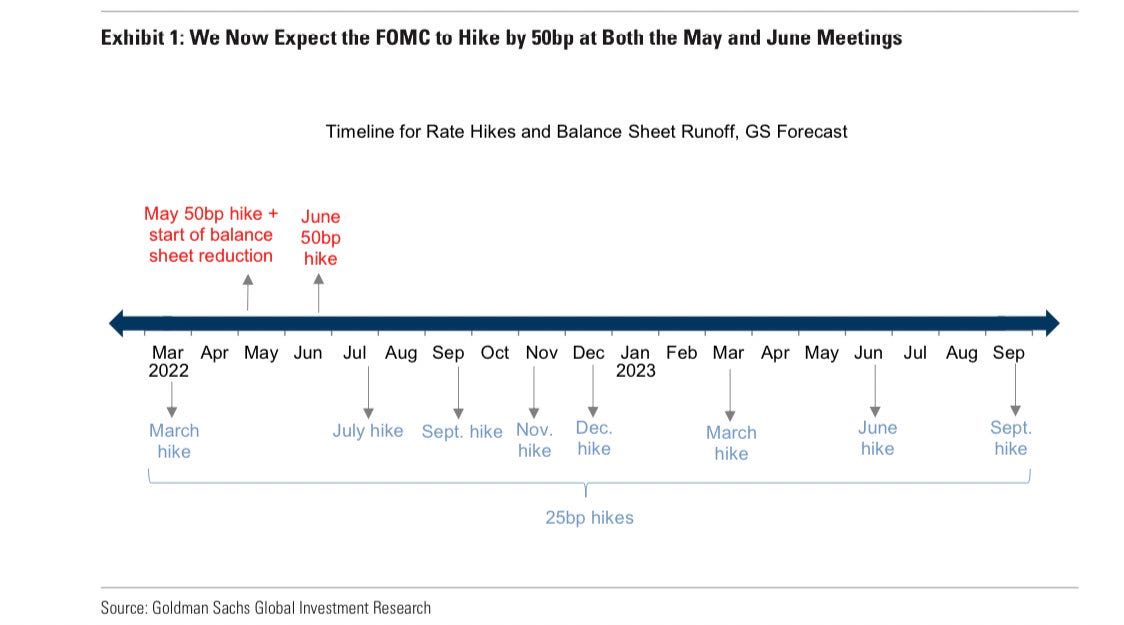

Some banks started to follow the more hawkish tone, and changed the rate hike estimates. For example, Goldman Sachs now believes that there will be a 50 bps hike in May, and other 50 bps in June.

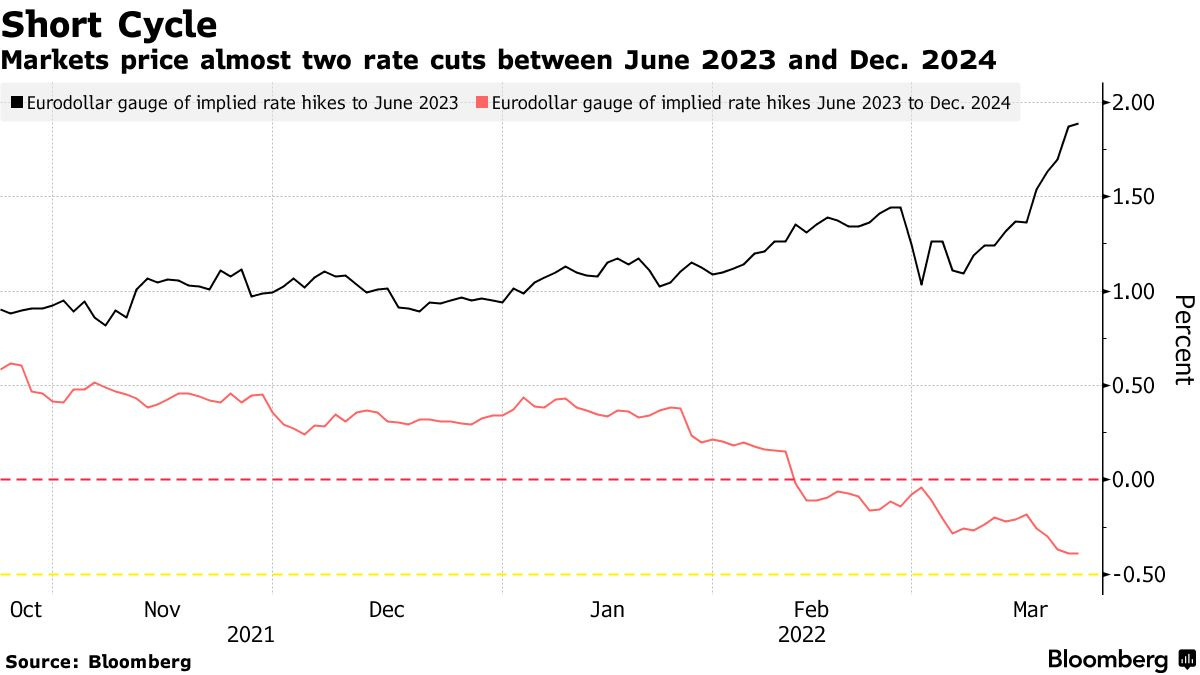

Does the market have the same view?

Not really.

Market is currently pricing 7 rate hikes for the rest of the year, but at the same time it is pricing 2 rate cuts between June 2023 and December 2024.

Implicitly investors believe that a new recession will arrive soon and the central bank will be forced to intervene again.

Another way to look at the fear of recession is through the yield curve, especially looking at the spreads between different maturities. Here you can see the current spreads:

One of the spreads above (3-10 years) is already negative and we are very close to see a yield curve inversion even on the spread 2-10 years. What does an inversion mean? Here a good explanation from Morgan Stanley.

So basically an yield curve inversion is considered a warning sign of an impending recession. Will this time be the same? Tough to say, but in a recent Survey from DB you can see how an increasing number of investors believes that a recession will arrive soon in U.S.

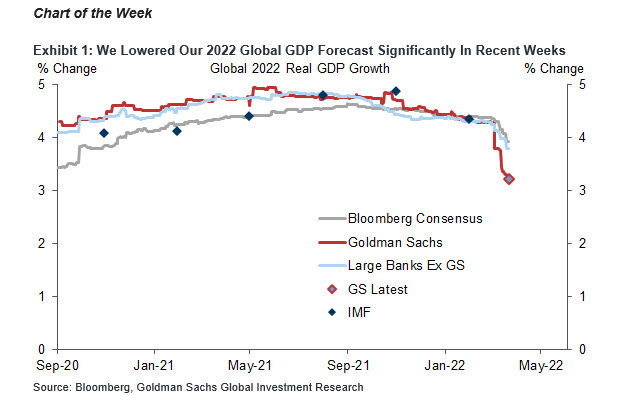

At the same time some analysts are reducing their estimates on U.S. GDP, and the chance to see a stagflationary scenario are increasing. Below you can see forecasts from Goldman Sachs:

Remember that Fed decision are data driven, so don’t take for granted the above estimates, and even the Fed forecasts. If data will indicate a declining inflation, the scenario will quickly change (and even if the inflation will rise more, of course).

The War in Ukraine

One month ago Russia decided to invade Ukraine. Now the war is still ongoing and the situation seems stalled. Both parties are negotiating and the chances to see a deal are increasing.

I think that markets are currently pricing a scenario in which the war will end in a few months and that Ukraine and Russia will reach an agreement. Indeed many equity indices (even in Europe) recovered all the losses suffered in the early days of the invasion.

Even in this case, market could be wrong and a deal can not arrive. Be ready for every possible outcome.

Where to invest now?

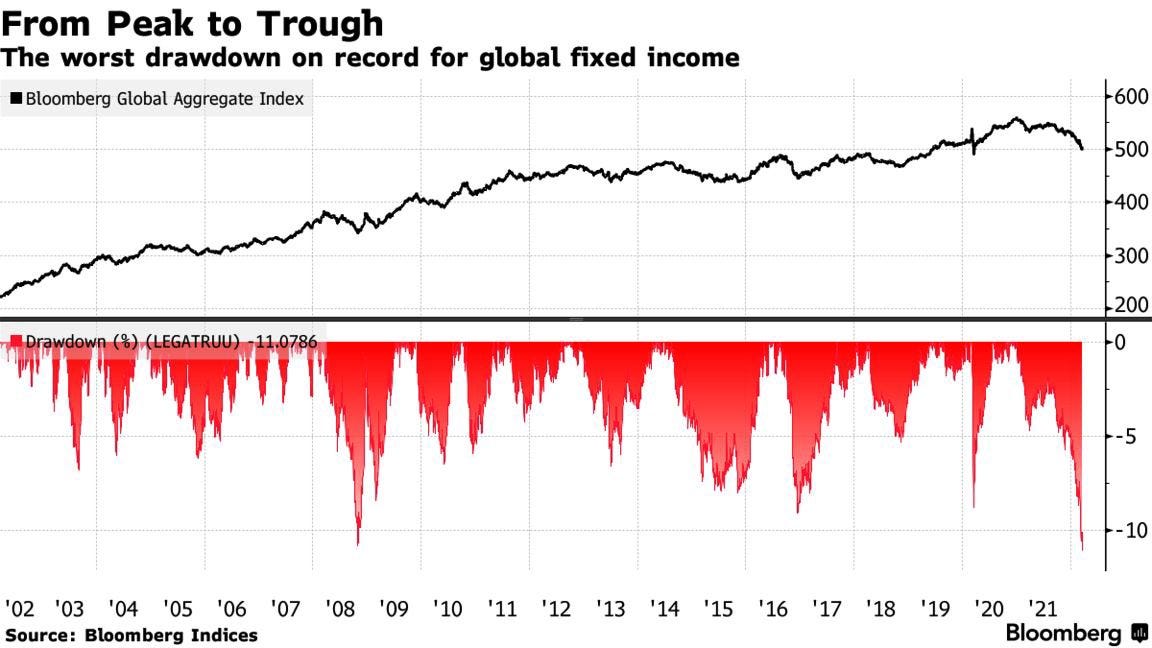

The first 3 months of the year have been not easy for investors, as both equity and bonds suffered, but in the last days we saw some signs on recovery on the equity side, while bonds are still experiencing a sharp decline.

In the last outlook (Read here) I wrote that U.S. and China were the best geographic areas for equities. Moreover I suggested to go long on U.S. large cap tech stocks. Both decisions have been good.

Moreover I saw gold as a good hedge: am I still positive there? Yes, but little bit less than couple of weeks ago. Real yields seems to have bottomed, and they have a negative correlation with gold. The rise of real yields, and even the stalled situation in Ukraine are two factors that are making me less positive on gold.

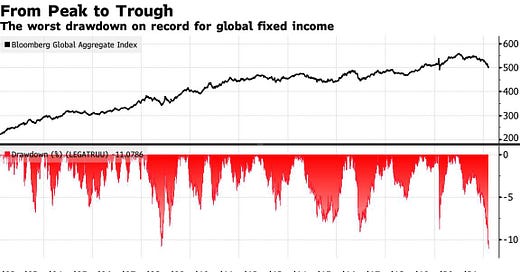

Bonds just had on of the worst drawdown of the century: is it time to buy?

In my opinion it can be a good idea to start to build a small position there, mainly on investment grade bonds. Some interesting ETFs for that? TLT and LQD. After the large fall, now yields are starting to look interesting again, and prices already consider a very aggressive central bank. The risk seems a bit more limited now.

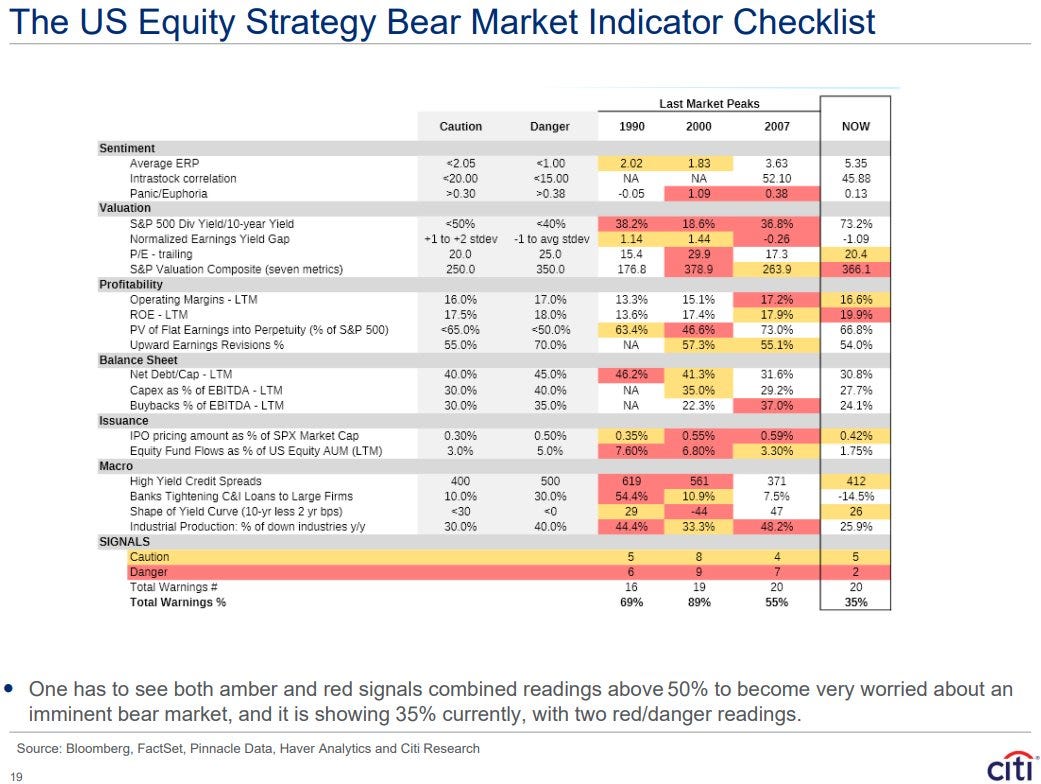

Equities remains my favorite asset class right now: despite the risk of recession and stagflation I still don’t see signs of a lasting bear market coming soon.

Even Citi Bear Market indicator seems good:

I confirm the overweight on U.S. and China, while I remain underweight on Europe and Emerging Markets.

Finally, I have to say that the recent geopolitical developments made me more positive on crypto (I already have a positive view): the recent sanctions from Western countries to Russia will make banks, corporations and people to rethink their money and reserve allocation, and cryptocurrencies can be a big winner in this scenario (people will probably have to find a way to hold money that cannot be blocked by any sanction in the future).

If you are a long term investor, you have to consider to allocate a small percentage of your portfolio to crypto.

Have a great week!

Market Radar

If you found the article interesting, please press the like button! It would be really important for the growth of the blog.

Remember: this is not a financial advice! Make your own analysis before to make any investment!

Follow my Instagram page if you want to be always updated on last market events.

If you are a long-term investor, Please consider to become a premium subscriber. For a small price, you will have full access to two model portfolios:

Balanced portfolio

Pure Stock Portfolio

Here you can see the introduction to the portfolios (Link) and the last update (Link) Moreover you will support my job here and on Instagram!

Disclaimer: Market Radar is not an investment advisor. Any information provided as part of the services is impersonal and not specific to any person’s investment needs. You acknowledge and agree that no content published or otherwise provided as part of any service constitutes a personalized recommendation or advice regarding the suitability of, or advisability of investing in, purchasing or selling any particular investment, security, portfolio, commodity, transaction or investment strategy.

In this letter you said:

"Bonds just had on of the worst drawdown of the century: is it time to buy? In my opinion it can be a good idea to start to build a small position there, mainly on investment grade bonds."

Could you elaborate your thinking on this a little more? If the market + Fed are thinking several interest rate hikes throughout this year are likely then wouldn't that just depress bond prices even further? Why not just wait out until the rate hikes for this year have been carried out to buy bonds?

Also when you said "Equities remains my favorite asset class right now: despite the risk of recession and stagflation I still don’t see signs of a lasting bear market coming soon." I was wondering if you've considered using an options writing strategy to hedge against this. I wrote this article on using it on leveraged ETFs.

https://premiumincomeinvestments.substack.com/p/leveraged-income-generation?s=w

But even if you didn't use leveraged funds according to this paper it appears that options writing strategies outperform in both flat and bear markets.

https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.458.4882&rep=rep1&type=pdf

Curious on your thoughts.