Hello Guys,

This is my first article here on Substack, and I hope you will enjoy it.

I will try to give you a fresh update on what is happening on markets and what are my personal views for the future (but this is not financial advice). Please comment this post if you have any suggestion for improvements.

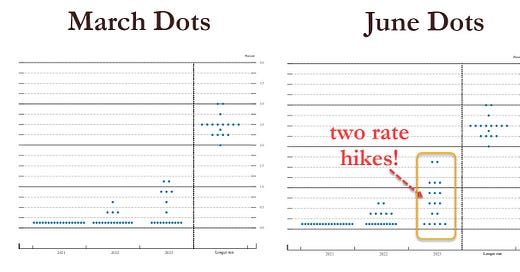

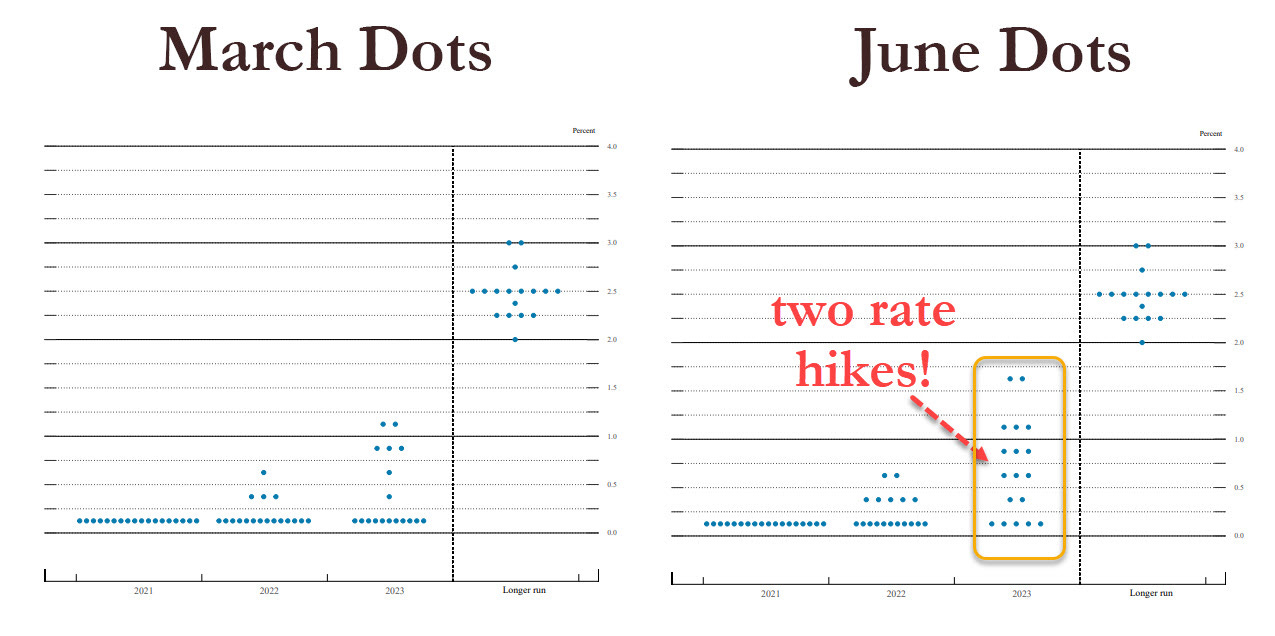

Let’s talk about markets: last week took place the FOMC and the FED proved to be more hawkish than it was in March. More voting members are considering two rate hikes within the end of 2023. Watch the dot plot here to see the difference (Source: Zero Hedge):

The reaction on markets has been quick and strong on some assets (like USD) and more confused on others (like stocks). On a theoretical basis you would expect the rates to go up, the USD to appreciate against the most relevant currencies, and the reflation trade to gain momentum (and tech stocks to suffer).

Instead there has been a very strong move on Treasury, but on the other direction: after an initial increase from 1.48% to 1.58%, the Treasury yield fell heavily, and on Monday it touched 1.36%. Since then we are now watching a new yield rise (today at 1.48%). I honestly used that dip to start to purchase an ETF short on Treasury (Ticker: TBF), as I bet on a bigger increase on Treasury yield and on a steepening of the yield curve. Remember that this is not a financial advice and I use stop losses to make plays like this.

Even the stock market had a confused reaction: the S&P 500 and Dow Jones went down for the second part of the week, while Nasdaq showed an extraordinary strenght, and it reached new fresh record levels. That move surprised many investors, since a more hawkish FED was supposed to favor more “cyclical” sectors, like commodities, materials, industrials. financials, and value stocks, while tech and growth stocks should be penalized.

It is likely that currently markets are pricing a very low possibility to see an inflation regime switch, and see the current inflation as “transitory”. For this reason the shock has not been big.

At the beginning of the year, many strategists predicted value stocks to overperform growth stocks: it happened until last week. The market moves post-FED Meeting reduced the gap between the two categories (see chart below). Personally, I still see the value stocks as an interesting spot in the short term, and it should perform better in a “rising rates” environment. Despite that, it is not time to stay away from Nasdaq: some names are too much interesting in the long term, and a great protection in case of some new Covid fear.

Here a recap of the S&P 500 stocks in the last 5 days (Source: Finviz):

Don’t underestimate other geographic areas: Europe is traditionally an area plenty of companies linked to “old economy” that should perform well in the current point of the economic cycle. Here a chart with the performance of the major global indices compared to S&P 500.

As you can see in the graph, Europe and U.S. are the best performers of the year, while Asian countries remain quite flat: after a strong start, Chinese equities is now unchanged, and it is struggling to go up. Even Japan is having a tepid year, mostly because a slow start of vaccination campaign and uncertainties on Olympics. Now they are making more than 1 million vaccines per day, and they should recover the delay accumulated quickly. I see an interesting play here, considering the attractive valuation of the index (Forward P/E not extreme).

To sum up, TINA (there is no alternative) remains the current mantra: dark clouds could arrive on government bonds, but tons of liquidity are still here and equities is the only place where the risk/reward ratio seems reasonable.

Moreover, recently Goldman Sachs posted a report where they see additional equity demand from Households and Corporations for 500 Billion USD for the rest of the year, because of record buybacks from companies and tons of private savings that are on the sidelines.

U.S. and European equities remain my favorite investment areas, but I am starting to look with interest at Japan and South Korea. Cyclical sectors remains my favorites so far: for example, european oil companies have a huge gap with oil price, and it can be a good catch-up play.

Finally I post some charts of indices and stocks that I find interesting right now:

European oil companies: time to close the gap?

APPLE: the break-out we were waiting for?

BAIDU: static support and trendline indicate an interesting entry point.

Like the post and comment below if you have any question or if you want to discuss about one of the points of the article.

Share the newsletter with your friends!

Have a great day!

____________________________________________________________________________

Disclaimer: Market Radar is not an investment advisor. Any information provided as part of the services is impersonal and not specific to any person’s investment needs. You acknowledge and agree that no content published or otherwise provided as part of any service constitutes a personalized recommendation or advice regarding the suitability of, or advisability of investing in, purchasing or selling any particular investment, security, portfolio, commodity, transaction or investment strategy.