2022: False start for U.S. equities

Lot of pain for U.S. stocks, but there are bright spots elsewhere

Hello guys,

Welcome back to “All Eyes on Markets”.

I just released the Balanced Portfolio for Premium Subscribers (you can find the link here), but remember that I will keep posting for free the market updates.

In case you have not subscribed yet, use the button below to do that!

Time to talk about markets!

U.S. equities worst in class

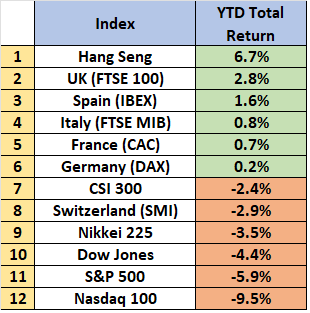

The year is just started but 2022 has not been good so far for U.S. stocks. The S&P 500, and especially the Nasdaq, are negative YTD, and among the worst indices on a global basis.

As you can see below in the picture, not everywhere the situation is so bad:

European equities are quite flat YTD, maybe because of their exposure to cyclical sectors.

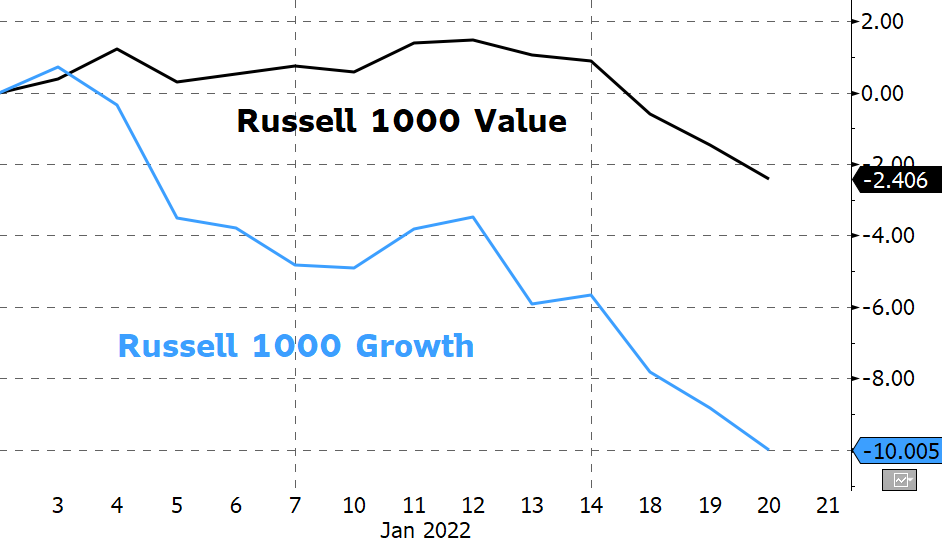

Indeed the value rotation is still in place, and the performance gap between value and growth stocks is widening:

Why so much pain?

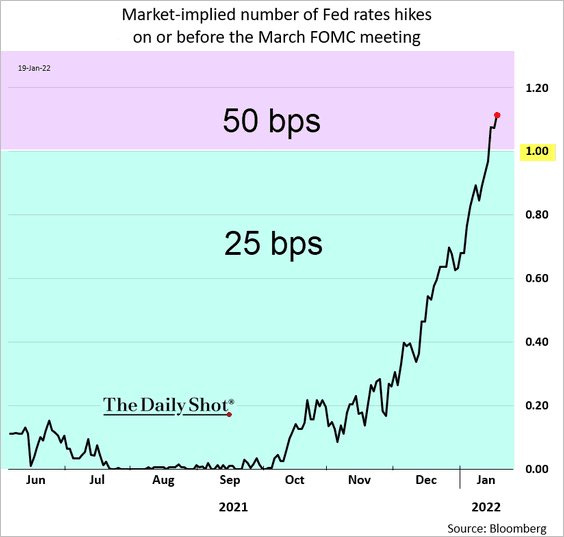

It is relevant to clarify why stocks, in particular growth stocks, are going down. The main reason behind that is the Fed: the first rate hike is close, but investors are assuming that the Central Bank will be more hawkish than expected.

Currently markets are pricing four rate hikes in the next 12 months, almost certainty:

Four rate hikes is the base case for most of the strategists, but someone is starting to see a more aggressive approach: for example, Bill Ackman.

Bill is not the only one to assume that. You can see that even markets are starting to price a small possibility to see a 50 bps increase in March:

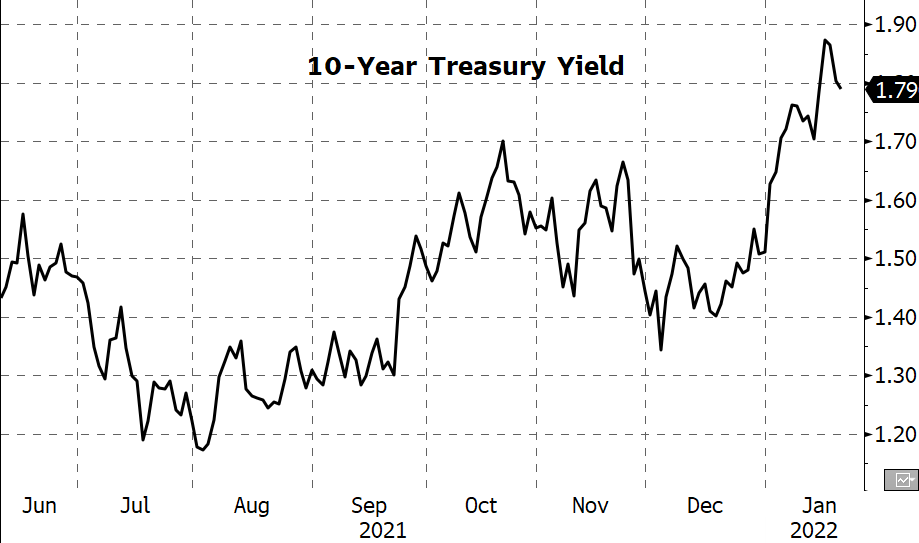

Of course all this hawkishness is sending the 10-Year Treasury Yield to the moon.

Is the Treasury sell-off close to the end?

I think that the current interest rate increase could be close to the peak (but of course this is just my opinion, that can be wrong).

Why? For several reasons.

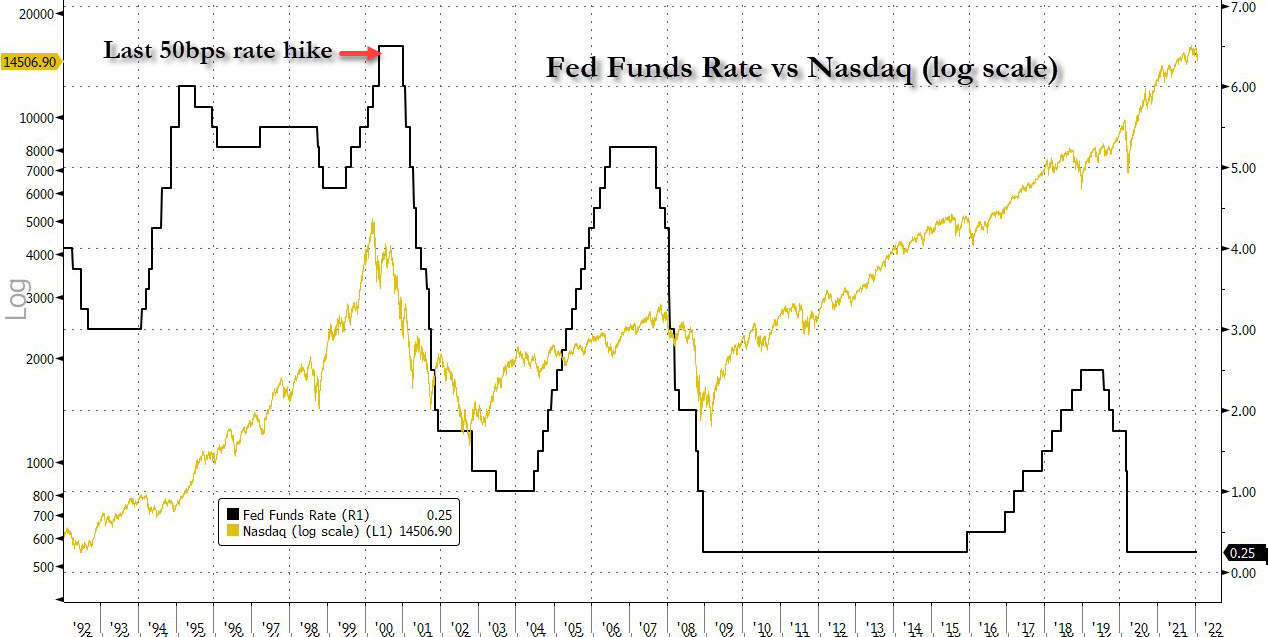

Firstly I don’t really believe that the Fed will make a 50 bps hike in March. The last time that they did a move like that was just before the Dot Com Bubble, in 2000. We all know that after the hike, markets collapsed (but definitely not only because of rate hike).

So I believe that markets are over-reacting right now, and that the Fed will not take the risk of stopping the economic recovery.

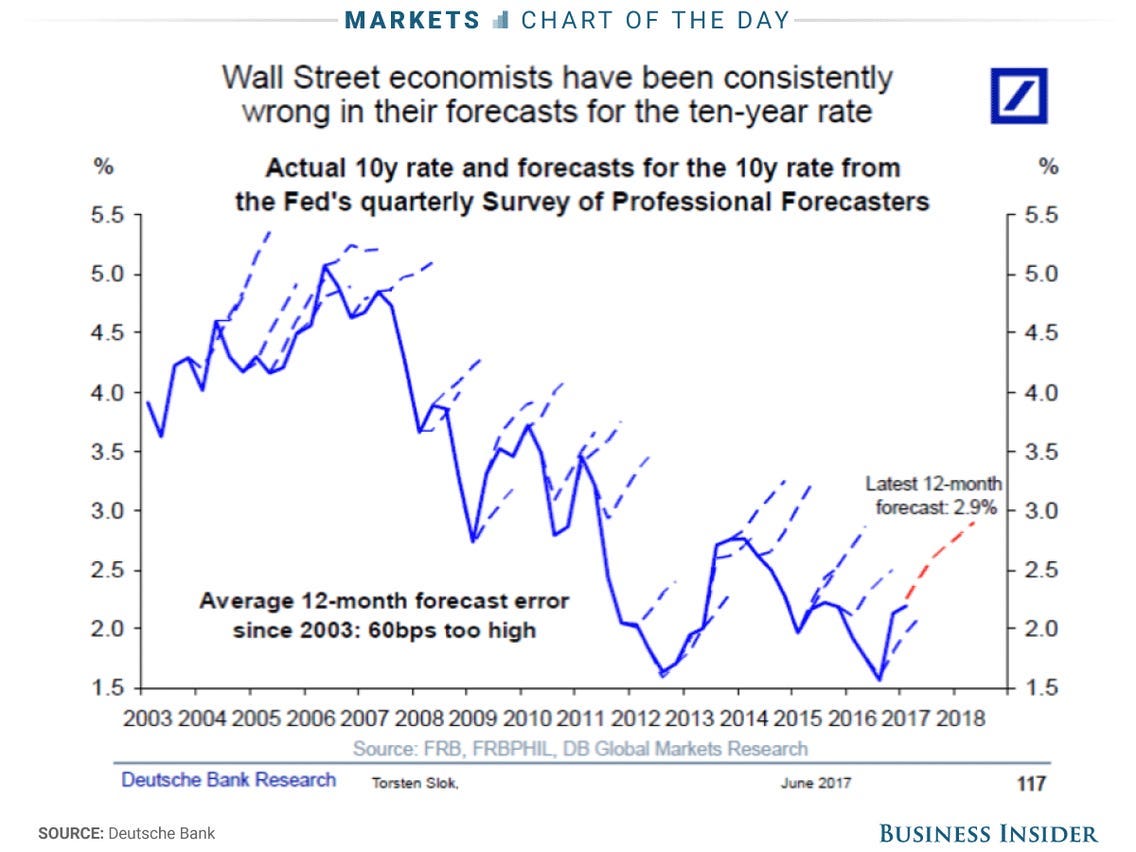

Moreover, there is another reason why I believe the sell-off could be over: most of the principal investment banks now see the Treasury yield between 2% and 2.2% by year end, and they proved in the past to be often wrong by overstating the target.

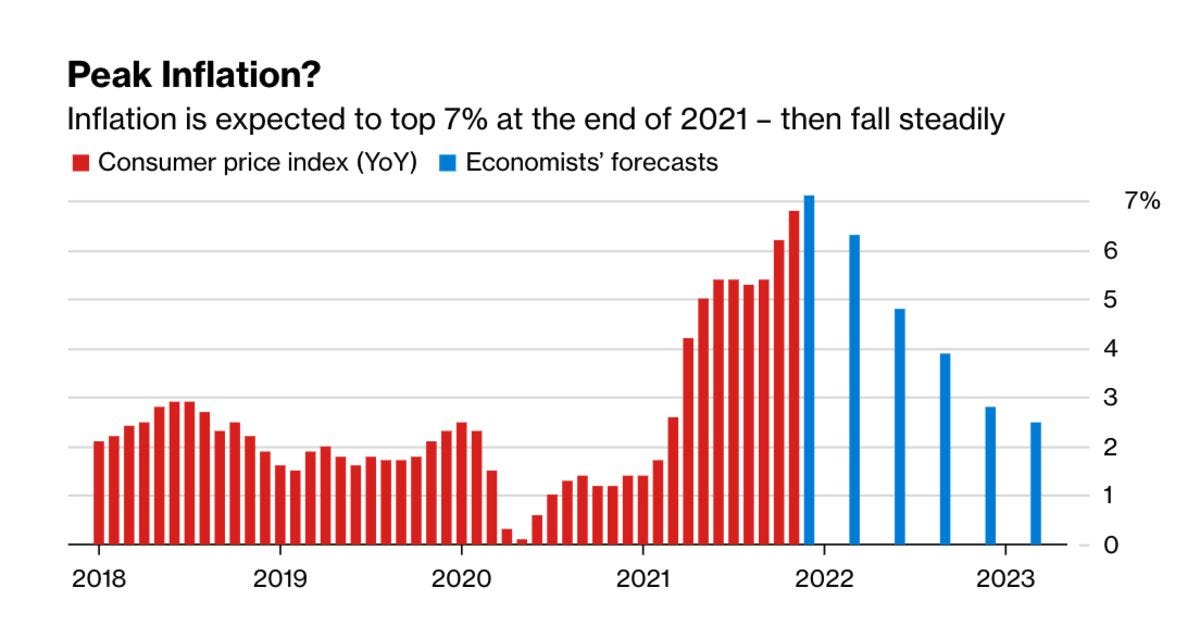

Of course all the above points can make sense only if inflation is close to the peak. Many economists believe that CPI will decrease starting from the end of this quarter (but as said above, don’t be sure about that). In this case I agree with them, and the reduction in the supply chain bottlenecks will probably help.

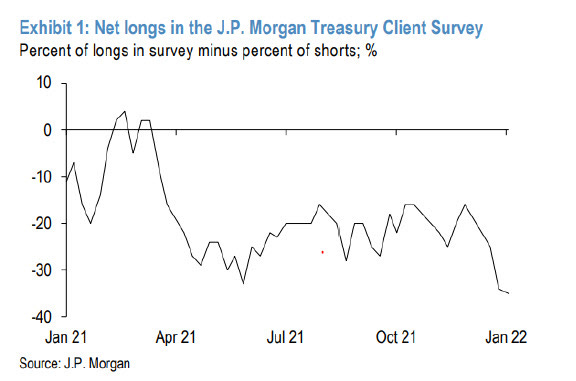

Finally, positioning on US Treasury seems quite extreme, as signaled by JP Morgan:

Can we see that as a contrarian signal?

Where to invest now?

The value rotation is paying well for now, and it can even last for a while, but the recent fall in tech stocks offers opportunities (especially if the Treasury yield is really peaking).

There are several tech large caps that now have a much more reasonable valuation, and I see space to start to accumulate some quality company.

The correction on tech stocks could not be over, but we are not here to buy on the lows (you will fail for sure). Dollar cost average can be a good way to build a position.

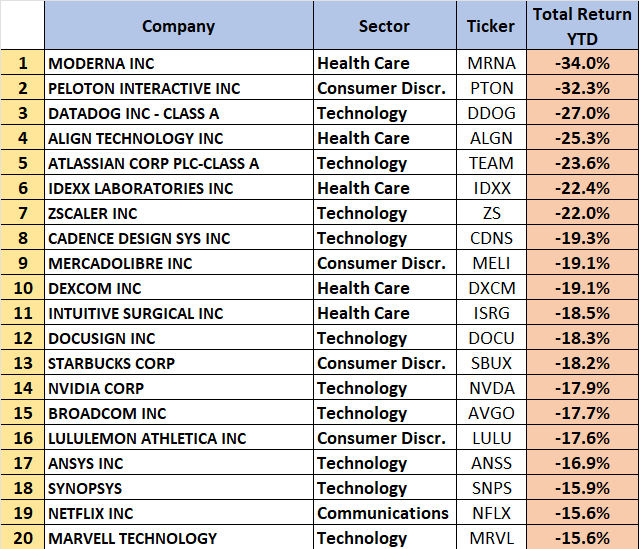

In any case, here you will find a list of the worst stocks of the year among Nasdaq 100 components:

Next week I will post the Pure Stocks portfolio for premium subscribers, in case you want to know my favorite companies at the moment.

On the other side, I continue to see financials and energy as positive sectors, but I would start to give a look to stocks related to Travel & Leisure. The recent positive earnings from few airline companies and the quick removal of restrictions in many countries are making the sector attractive again.

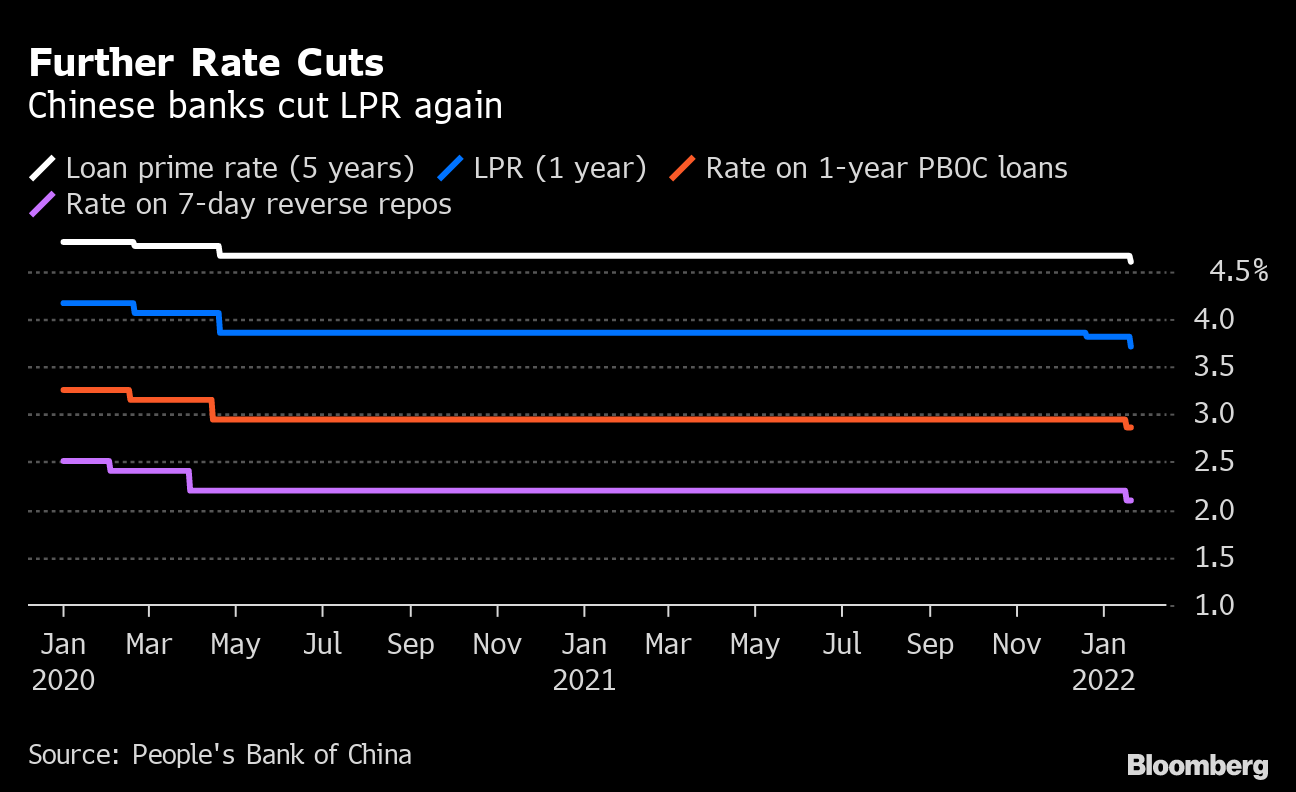

Finally, Europe remains my favorite geographic area, but I would suggest to give a look at China, especially because the PBOC (Central bank) is starting to cut rates again.

The potential upside for Chinese tech stocks is very large!

Thank you for your support!

Have a great weekend,

Market Radar

Remember: this is not a financial advice! Make your analysis before to make any investment!

Follow my Instagram page if you want to be always updated on markets.

Disclaimer: Market Radar is not an investment advisor. Any information provided as part of the services is impersonal and not specific to any person’s investment needs. You acknowledge and agree that no content published or otherwise provided as part of any service constitutes a personalized recommendation or advice regarding the suitability of, or advisability of investing in, purchasing or selling any particular investment, security, portfolio, commodity, transaction or investment strategy.